What You Required to Know Before You Submit Your Online Tax Return in Australia

What You Required to Know Before You Submit Your Online Tax Return in Australia

Blog Article

Navigate Your Online Income Tax Return in Australia: Essential Resources and Tips

Browsing the on the internet tax return process in Australia requires a clear understanding of your commitments and the sources available to enhance the experience. Important records, such as your Tax Obligation File Number and income declarations, should be diligently prepared. Picking a proper online system can dramatically influence the effectiveness of your filing process.

Recognizing Tax Obligation Responsibilities

Understanding tax obligations is necessary for people and businesses running in Australia. The Australian taxes system is controlled by different legislations and regulations that call for taxpayers to be knowledgeable about their responsibilities. Individuals must report their earnings accurately, that includes incomes, rental income, and financial investment profits, and pay taxes accordingly. Moreover, citizens have to understand the distinction between non-taxable and taxable revenue to make sure conformity and maximize tax obligation results.

For businesses, tax obligations encompass several facets, consisting of the Item and Provider Tax Obligation (GST), company tax obligation, and payroll tax obligation. It is important for services to sign up for an Australian Service Number (ABN) and, if appropriate, GST registration. These responsibilities demand thorough record-keeping and timely submissions of tax obligation returns.

Furthermore, taxpayers ought to know with readily available deductions and offsets that can relieve their tax obligation concern. Consulting from tax specialists can supply important understandings into enhancing tax obligation positions while making certain compliance with the regulation. In general, a comprehensive understanding of tax obligation obligations is crucial for effective economic planning and to avoid charges associated with non-compliance in Australia.

Necessary Papers to Prepare

Furthermore, put together any type of pertinent bank statements that show passion revenue, along with reward statements if you hold shares. If you have other income sources, such as rental residential properties or freelance job, guarantee you have documents of these profits and any kind of linked expenditures.

Do not neglect to consist of deductions for which you might be qualified. This may include receipts for occupational expenses, education and learning prices, or philanthropic contributions. Take into consideration any type of personal health and wellness insurance coverage statements, as these can influence your tax obligation obligations. By collecting these crucial records in breakthrough, you will improve your online income tax return procedure, reduce errors, and make best use of possible refunds.

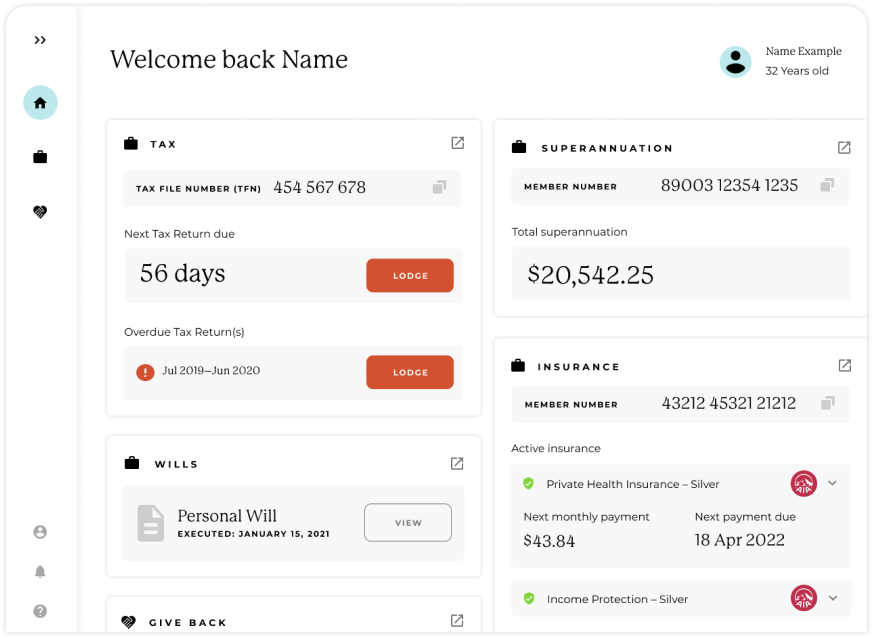

Picking the Right Online System

As you prepare to submit your on the internet tax obligation return in Australia, choosing the best system is necessary to guarantee precision and convenience of usage. An uncomplicated, instinctive design can considerably improve your experience, making it less complicated to browse intricate tax obligation kinds.

Next, examine the system's compatibility with your financial situation. Some solutions cater specifically to individuals with easy income tax return, while others give webpage extensive support for a lot more complicated circumstances, such as self-employment or investment earnings. Moreover, seek systems that supply check my site real-time mistake checking and guidance, assisting to minimize mistakes and ensuring compliance with Australian tax laws.

An additional vital element to take into consideration is the degree of consumer assistance offered. Trustworthy systems need to supply access to support via chat, email, or phone, particularly during top filing durations. In addition, research individual evaluations and ratings to determine the general contentment and integrity of the platform.

Tips for a Smooth Declaring Refine

If you comply with a few vital ideas to ensure performance and precision,Submitting your on the internet tax obligation return can be a simple process - online tax return in Australia. Initially, gather all required papers before beginning. This includes your earnings declarations, receipts for reductions, and any various other appropriate documentation. Having whatever available lessens disturbances and mistakes.

Next, capitalize on the pre-filling attribute offered by numerous on the internet systems. This can conserve time and reduce the chance of errors by instantly inhabiting your return with details from previous years and data offered by your employer and banks.

In addition, double-check all entries for accuracy. online tax return in Australia. Mistakes can cause postponed reimbursements or concerns with the Australian Taxes Workplace (ATO) See to it that your individual information, revenue numbers, and reductions are proper

Be mindful of deadlines. If you owe taxes, filing early not only reduces stress and anxiety however also permits for far better preparation. If you have uncertainties or questions, seek advice from the aid areas of your selected system or look for specialist advice. By adhering to these ideas, you can navigate the on-line tax obligation internet return process smoothly and confidently.

Resources for Assistance and Assistance

Navigating the intricacies of on-line tax obligation returns can sometimes be daunting, but a range of sources for assistance and support are readily available to help taxpayers. The Australian Taxes Office (ATO) is the primary source of details, supplying detailed guides on its internet site, including Frequently asked questions, instructional videos, and live conversation choices for real-time assistance.

Furthermore, the ATO's phone assistance line is available for those that like straight communication. online tax return in Australia. Tax obligation specialists, such as licensed tax representatives, can also offer personalized guidance and ensure conformity with current tax guidelines

Verdict

In conclusion, efficiently navigating the online income tax return procedure in Australia calls for an extensive understanding of tax responsibilities, thorough prep work of essential files, and careful selection of a proper online system. Abiding by useful tips can boost the filing experience, while offered sources use important help. By coming close to the procedure with persistance and focus to detail, taxpayers can guarantee conformity and optimize prospective advantages, ultimately adding to a more efficient and successful income tax return outcome.

As you prepare to file your on the internet tax obligation return in Australia, picking the appropriate system is vital to ensure precision and convenience of usage.In final thought, successfully navigating the on the internet tax return procedure in Australia calls for a complete understanding of tax obligation obligations, thorough preparation of vital files, and cautious choice of a proper online system.

Report this page